It is critical for every company be it a large multinational, small and medium size entity, NGO or government owned entity, to have a well defined control frame work implemented that includes a credit risk process.

First, have a disciplined collections process defined and executed. It keeps the accounts receivable amount low. This requires pre-collections activities for customers, who tend to pay late. It is used to gently remind these customers about open invoices, and asks if they received the goods or services to the price and quantity that was agreed upon, and also received a correct invoice. If this is all OK, they should have recorded the invoice in their ERP system, and made it ready for payment on due date.

Past due invoices need to be followed up by collections/ receivable specialists diligently. Achievable goals for the collections team are important to keep a very low level of past due accounts receivables. If the entire process runs smoothly, you have your accounts receivable position at the balance sheet close to the best possible days sales outstanding (DSO) level. This means that you require less financing of these amounts, be it from an equity or debt perspective. Subsequently, your weighted average cost of capital (WACC) is lower by either paying less dividends, or less interests.

It is a must, to have a strong reporting in place for achieving this high level of collection quality. Here an example: A large chemical giant was able to reduce past due accounts receivables from 20% to 5%.

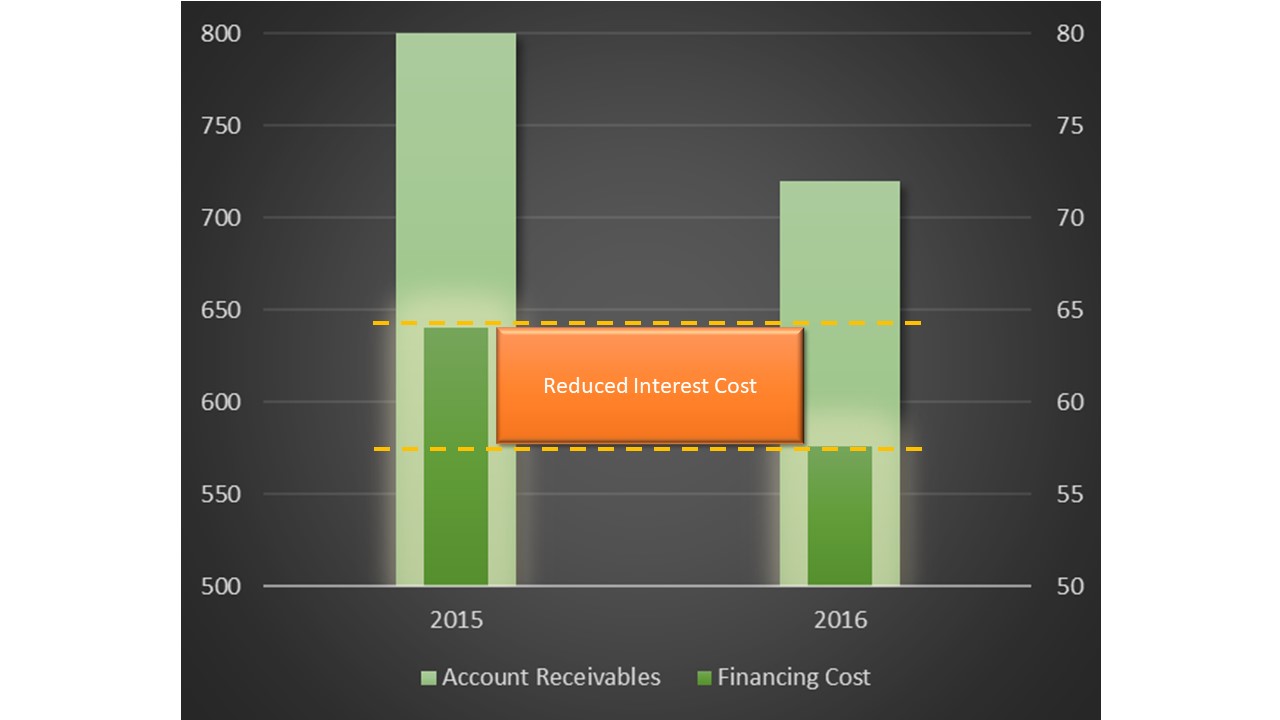

This was a reduction of the total accounts receivable position by 10% or 80 million USD. With a WACC of 8%, they saved more than 6 million USD per year. You can find more about reporting instruments in the book ‘Credit Risk Management – Code of Best Practice‘.

Second, your company requires a credit risk management process for analyzing your customers’ credit risk and cluster them in low, medium, and high risk. For this you should use a credit scoring model that calculates weighted average scores from liquidity, profitability, and financial leverage, down to an end score and a recommendation of a credit limit that should not be exceeded. Having this deep understanding of your customer portfolio, you are able to work on risk mitigation instruments actively.

Outcome is a reduced risk of default of your company’s accounts receivable position. If you have this process audited and certified, you have an improved negotiation position with your financial institutions if it comes to financing costs.

Also, you can use the same credit scoring model and analyze your own company’ financial statements, and actively search for ways to improve these.

Emerald Rating is an award-winning FinTech company providing a credit risk scoring calculator to mitigate credit risk.

Author: Danny Kaltenborn, Date: January 31, 2020