“Now I have a tool on hand that helps me knowing the fundamental value of my shares relative to market expectations” – Private Investor

Do you want to understand if the stock that you intend to buy is under- or overvalued?

Push the ‘Start’ button and enter balance sheet and profit-loss statement data for the most recent two years of the publicly traded company, as well as it’s current market capitalization.

Outcome is a share price evaluation, which compares the fundamental value of the incorporated company with it’s market expectations.

You might have a certain amount of money that you don’t want to leave on your bank account, but to invest. You have several options of doing this:

- You can ask your bank to take the money and invested it for you. Your bank will keep a certain percent of your profits for providing this service to you.

- You could invest in real estate. This way of investing requires a high amount of capital, which you might not have yet.

- You could build your own stock portfolio alternatively.

Key rules for being successful of investing in shares are the following:

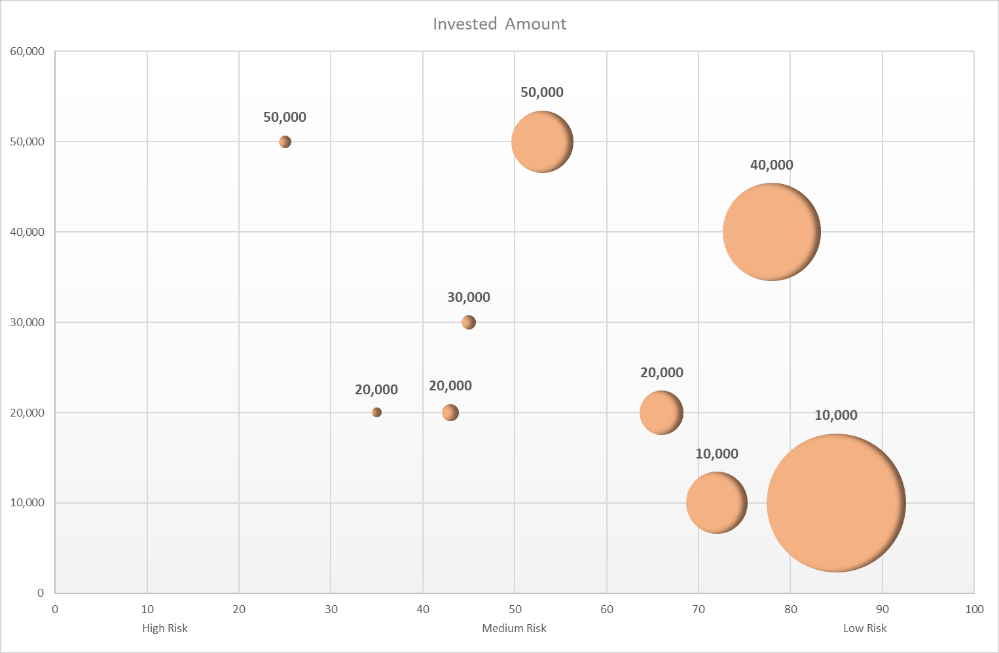

- Spread your capital (invest in at least 7 different shares)

- Understand the companies in which you want to invest and their business models. Do you agree to it, also from ecologial, social, and governmental (ESG) aspects?

- Use a share price scoring calculator, which calculates the fundamental value of these companies, and compare it against the market expectations (market capitalization). This market capitalization is the total of all subjects trading the shares and their future expectations of the fundamental values. If you think this is overstated already, don’t invest. Only buy at attractive prices.

- Set yourself target share prices for selling the shares again. Don’t be greedy and take your time!

- Keep in mind that all profits that you make, that are above the fundamental rational, will allocate money from someone else. Ask youself, if you want this to be happen.