Have you been looking for a reporting tool that brings the results of individual business partner risk assessments together in one graph to understand if your portfolio risk is balanced? If yes, you might find this article valuable.

Customer Portfolio Risk Assessment

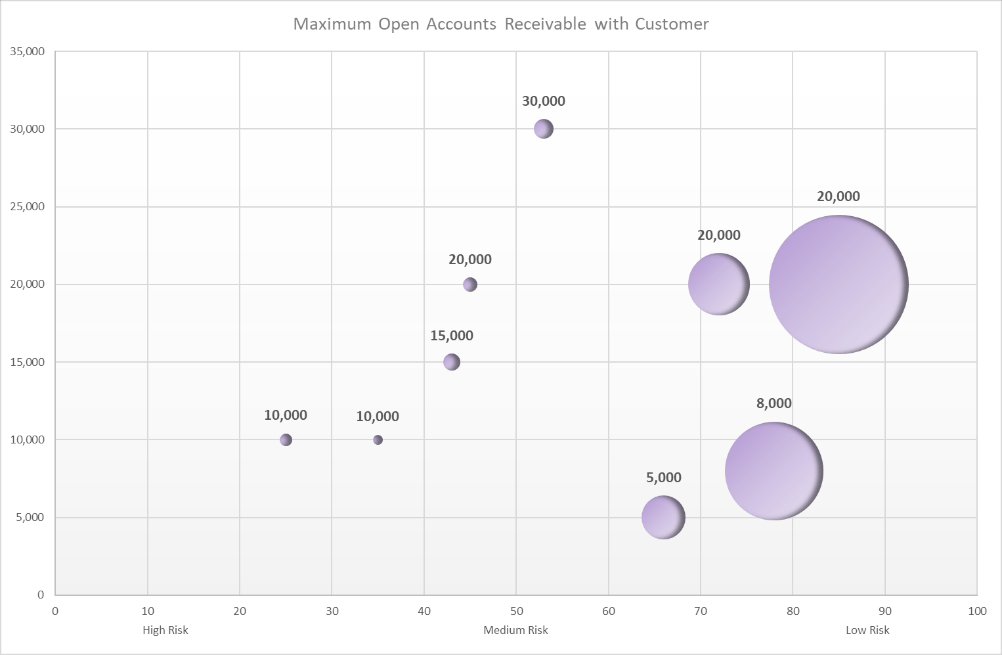

Let’s start from the output of what we expect to have. Below picture could be your customer portfolio. Vertically (y-axis) it shows the maximum amount of open invoices that you might have with each of your customers. Horizontally (x-axis) it is the risk score that your received for each of your customers from the individual customer risk assessments (Purple platform). The size of the bubbles is the size of the customer in terms of revenue.

Which customers do we prefer in our portfolio? Correct, large companies with low risk and low maximum open accounts receivables. The sweet spot is in the bottom-right corner. The riskiest spot would be at the top-left corner of the picture. In practice your customers are spread across the field and you will work on it to keep it balanced and if not lead your negotiations in a way that you can accept the risk.

In other words, from a strategic (long-term) perspective you work on your customer portfolio to mitigate the risk and push towards the bottom-right corner. You start with customers, with the most impact; those from the top-left corner.

Free Portfolio Risk Review Purple Report

Supplier Portfolio Risk Assessment

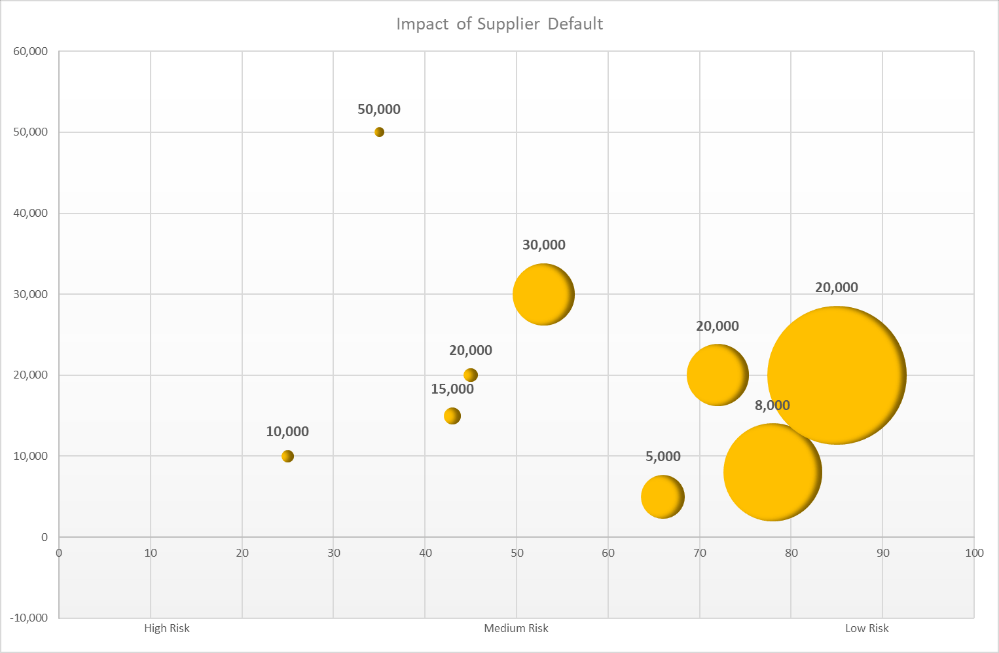

The supplier portfolio risk assessment is similar to what we discussed for customers. We replace the value for the vertical (y-) axis with the impact of supplier default. This is the amount of money, that we lose if a supplier can’t serve us anymore. Worst case is a sole supplier, who provides you with a critical part and is the only one who can do it. A critical part must not be very expensive, but it might cause a shutdown of your own production process, which then leads to losing sales and profitability with it. If he goes bankrupt it will have a material impact to our company. You would see these suppliers in the top-left corner of the below graph.

In order to mitigate a supplier default risk, you will need to sit together with each of the high-risk candidates with material impact for you and find a solution together how to develop them in a way that their risk is lower by discussing the results of the risk assessment of the Yellow platform. You might even consider to acquire a supplier for risk mitigation.

Free Portfolio Risk Review Yellow Report

Stock Portfolio Risk Assessment

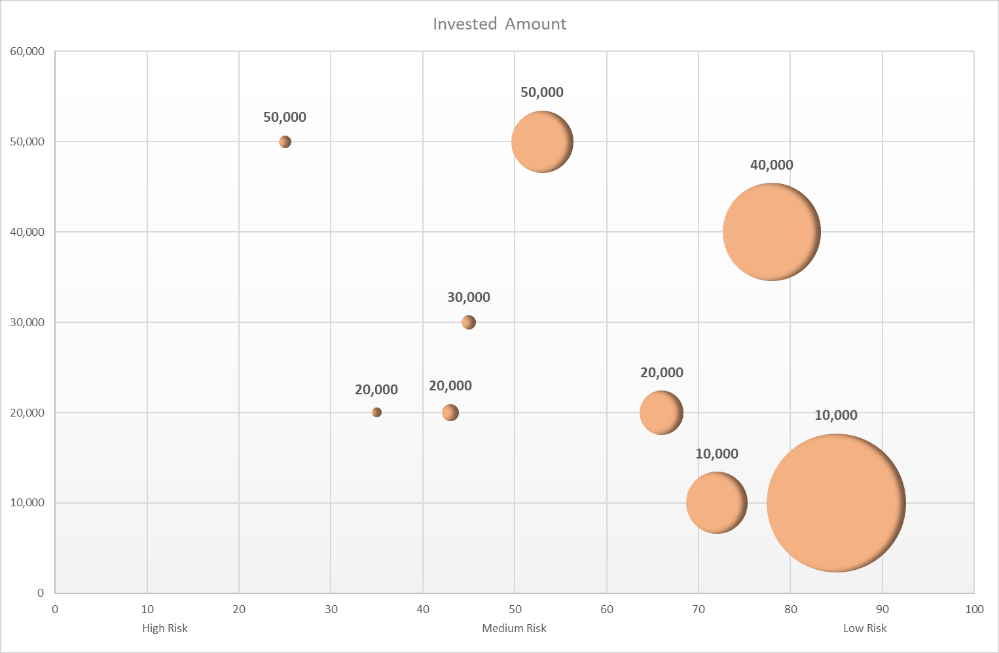

In the case of analyzing the risk of a stock portfolio the invested amount is going to be set in context with the risk score. Latter one is derived from the Orange platform report for each single company. The larger the invested amount and the higher the risk, the higher the potential impact of losing money from your investment. The higher the risk as higher return from dividend payments and share price increase should come with it. If this is not the case you should consider to sell and shuffle funds to either other less risky companies in your portfolio or take new shares to your stock portfolio.

In the above picture you should have a close look to the small bubble in the top-left corner, in which you invested 50,000 in. Try to understand from the Orange platform report, what drives the low score (high risk). Also read the financial statement report with it and gain an understanding of the reasons behind. If you agree with the risks the companies accept, and if you are willing to accept these risks too, then hold it; if not – sell it.

Free Portfolio Risk Review Orange Report

Author: Danny Kaltenborn